In this post I will post all my observations and findings related to each 5:30 news release and subsequent moves of 2022.

11/4/2022

Before

5m: Bear stacked and down wave, but coming off 15m 34.

15m: Bull stacked so it’s not ready to dump. Has higher high with divergence, requiring a down wave.

1H: Bear stacked but on its way up overnight, should try to close higher than it is.

4H: Bear stacked but decreasing MACDH, may be on its way up.

Analysis:

5m has a dip here to rebound off 15m 34. Market wants to break yesterday’s overnight Open/Close first, and then potentially highs.

Initial break takes it down (with bear stacked 5-1h) to break yesterday’s lows. Then, reversal comes immediately, because 15m is still bull stacked. Also note that 1H has 21 resistance right before release.

Because we open near the open/close, there is resistance forcing it down. 5m rebounds with another shallow wave, this time off of the current day/overnight’s open/close.

The initial low break was satisfactory (overnight low), so we don’t get a full run through lows again. Instead, the drop stops with a deep 5m wave B, and a near valley reversal to get the market back on 1-4H trend.

Summary:

Initial open down off 1h Resistance, break overnight low. Recover, break overnight open/close. Drop, respect current yesterday’s close, recover (maybe also because 5m open was not signaled). This recovery sets up a higher high and bigger longer drop, which respects today’s open. Then, recover to resume initial trend.

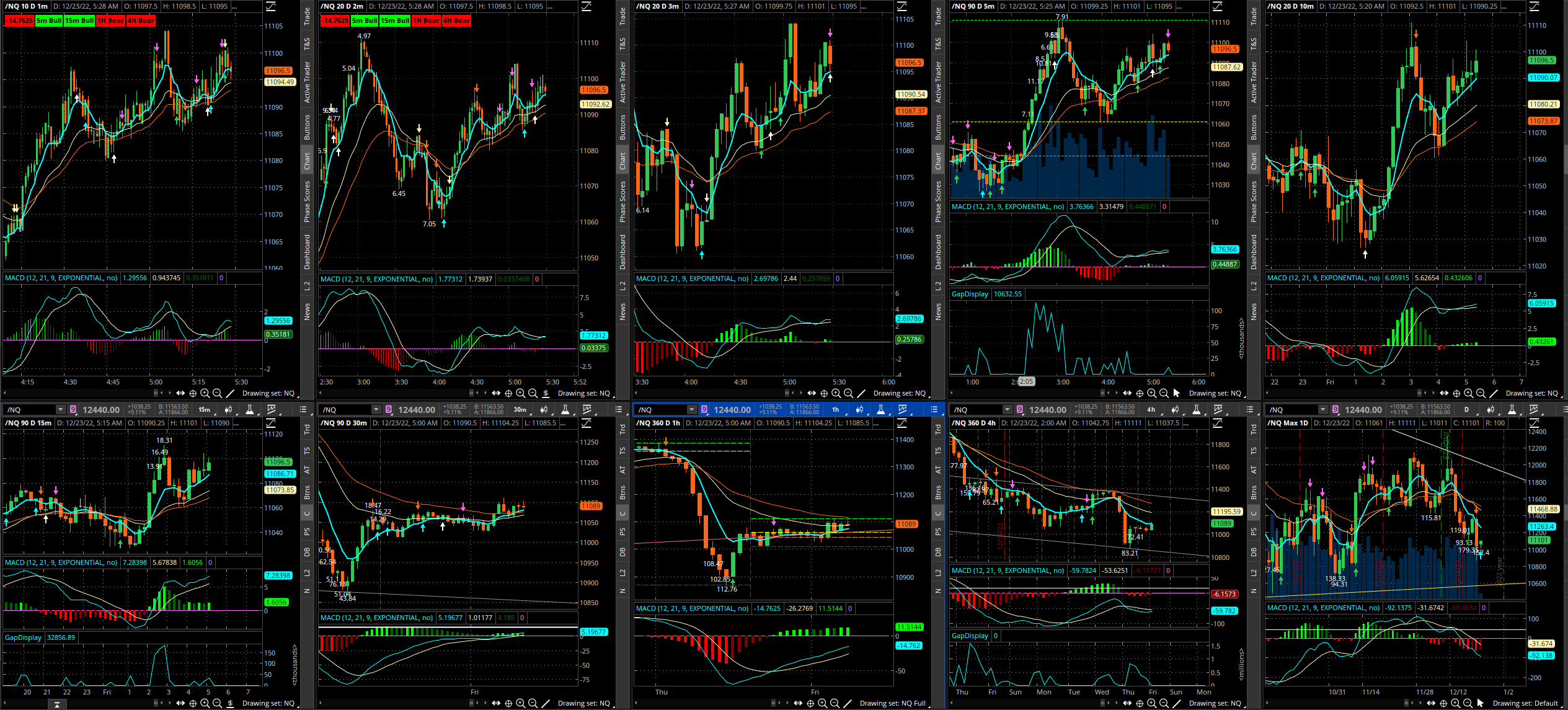

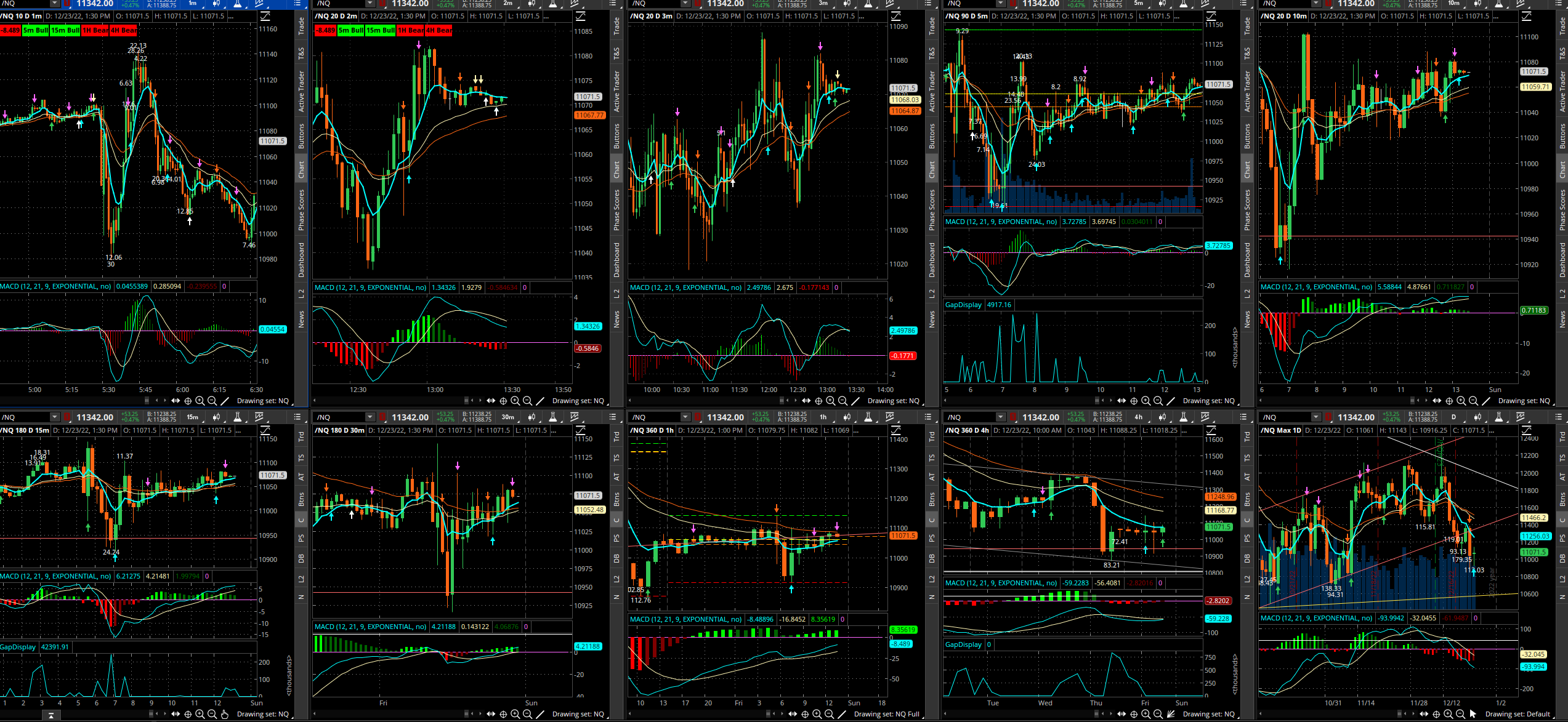

12/23/2022

5m: Bull stacked and wanting new high.

15m: Bull stacked trying to get new high.

1H: Bear stacked, on its way up overnight, should try to close higher than it is.

4H: Bear stacked but decreasing MACDH, still down but more sideways.

Analysis:

1H needed to go up, and the news dumps initially. This dump is immediately corrected because it comes without a proper signal. Then, the 5m rises to a higher high, and dumps for the “fake” move as part of the news, going against the real trend direction (up). Once it gets to the top of the hammer to the left (previous day), it stops and reverses for the original trend.

Because the open/close are nearby, this news doesn’t care about these levels. 15m gets its new high, although with decreasing MACDH, so it doesn’t trend higher immediately.

This is a bit sloppy of a move, not worth over-trading.

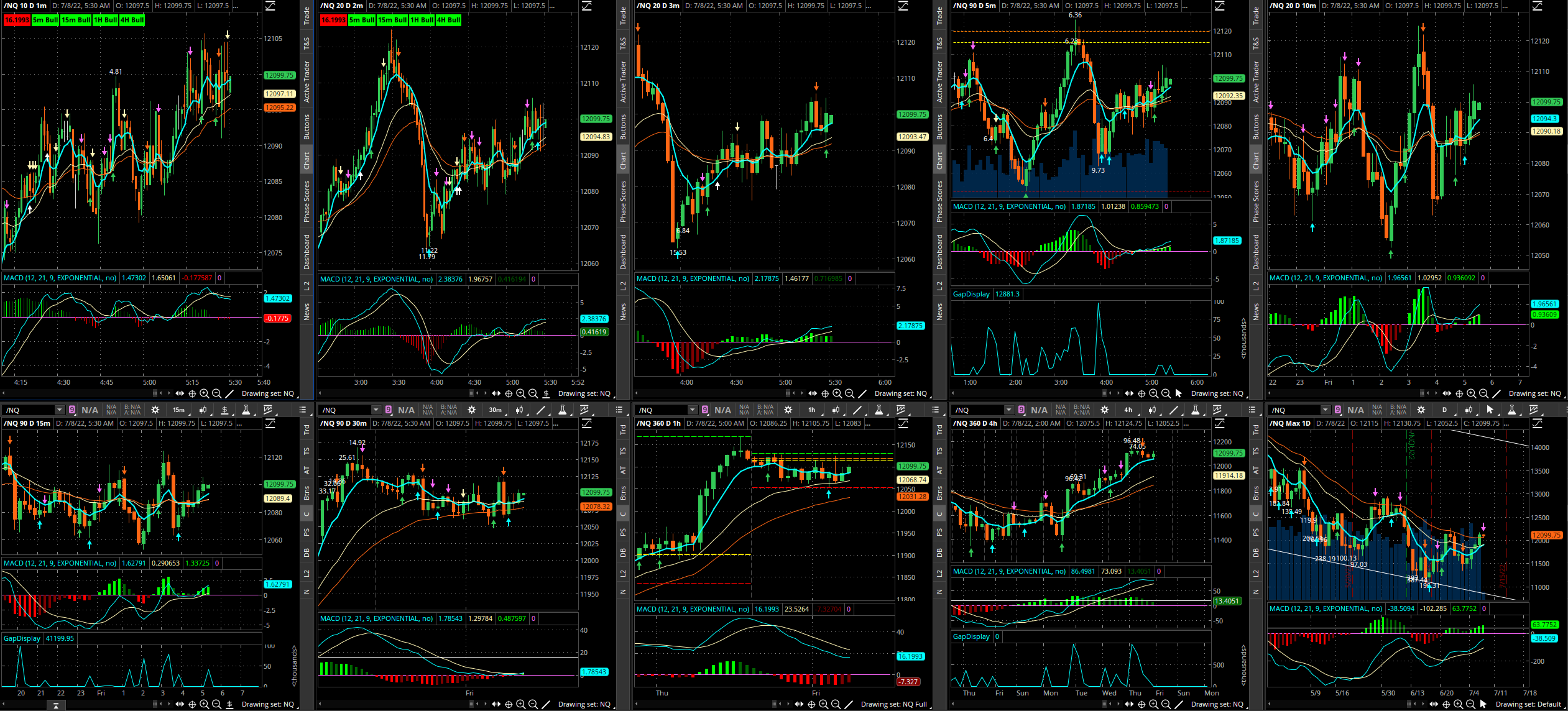

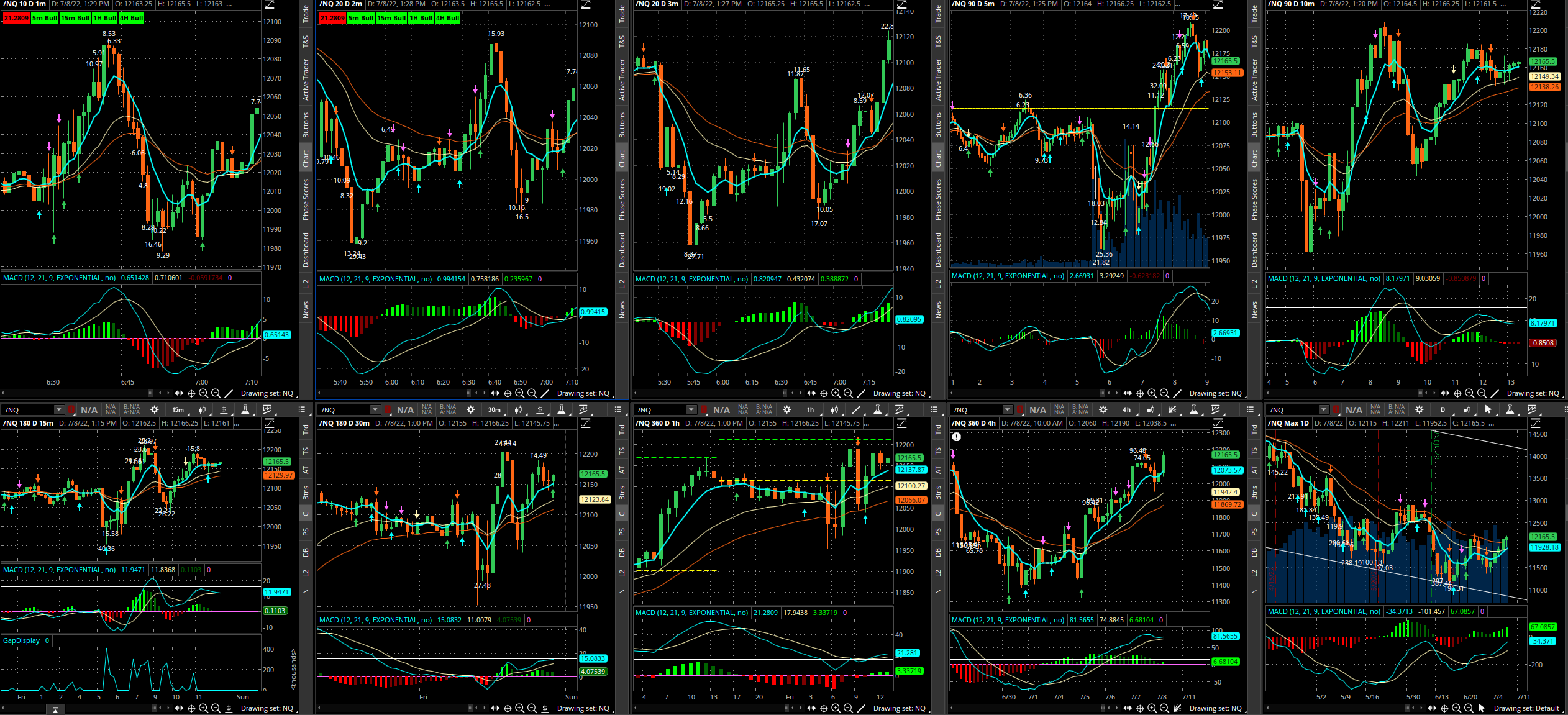

7/8/2022

Here we have another very clear dump into a 15m reversal signal, which turns into a bullish run. But the run isn’t the most strong, and it pauses at the 5m 34, which is textbook. 1m opens above 0, runs a bit, drops 100 points and resumes to finish the valley reversal.

This is an incredible example of the predictability of the market.

What began as a curiosity about why the 5m had a fake 34 rejection instead of a new low, is suddenly explained upon understanding the 15m setup that occurred earlier. This is what we saw in October 2023 as well.

There are a few differences, however. The market begins bullish here on all time frames. We have a 5m pullup that’s coinciding with a 30m straddling the 0 line but not having a proper wave.

1H coming off the 21 with 15m wave, it would seem that we should have a spike upward. But news can always spike in the wrong direction initially, which is what it does here. Once it does, 15m makes a bullish harami hammer and the rest is straightforward.

The most important thing to note is the way the 1m behaves after the open. It tempts you into a 1m 34 bullish move, but needs to stop at the 5m 34 and retrace before the full move.

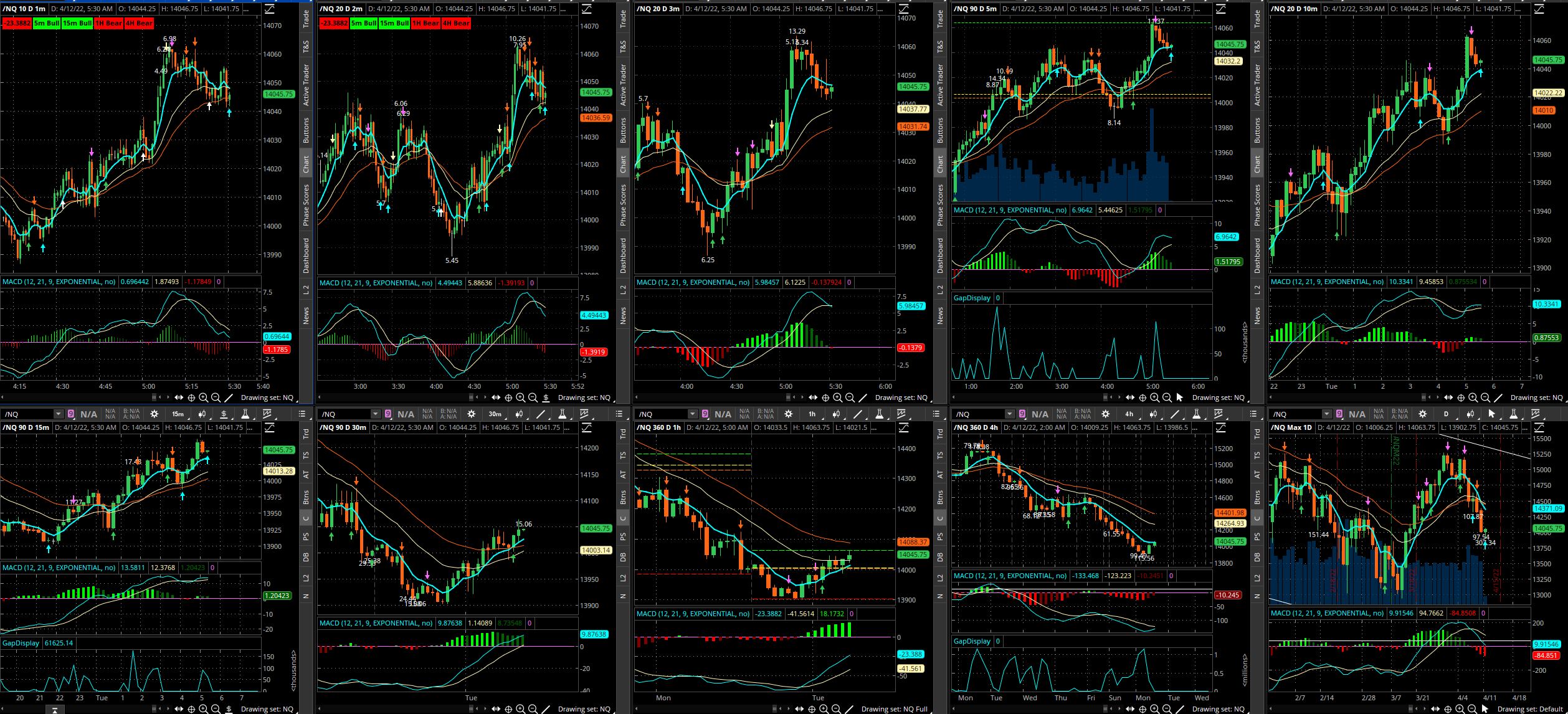

4/12/2022

This market is poised for a bullish spike because of 15m and 1H being up, but recognize that the next resistance is 1H 34, 4H 21, and it gives an upside to look for. Also, the previous day’s open/close is around 327.

Note that the 15m 34 comes with 5m wave, a strong bullish new high required, which news provides. Then, after hitting 4h 21, and getting a 30/1h Wave, we get a pullback.

Market opens, 1m coming off unstacked 34 at 6:26. This gives us a push downward in line with the downward reversal. This stops after just 7 minutes, and pulls up. This comes off the 5m 34, and produces a 140-150 point pop back upward.

Traditionally, we’d expect 100 points, but here we get no slowing down as 1m crosses 0. A bearish signal comes before the 0 line, just after the 0 line, and then very late with a 34 test and new high. Only the third one is valid because it’s not a shallow wave at that point, and 5m bullish candles had a chance to close. We must not rush into the first bearish/bullish 1m 7J, waiting instead for a significant candle and deeper wave.

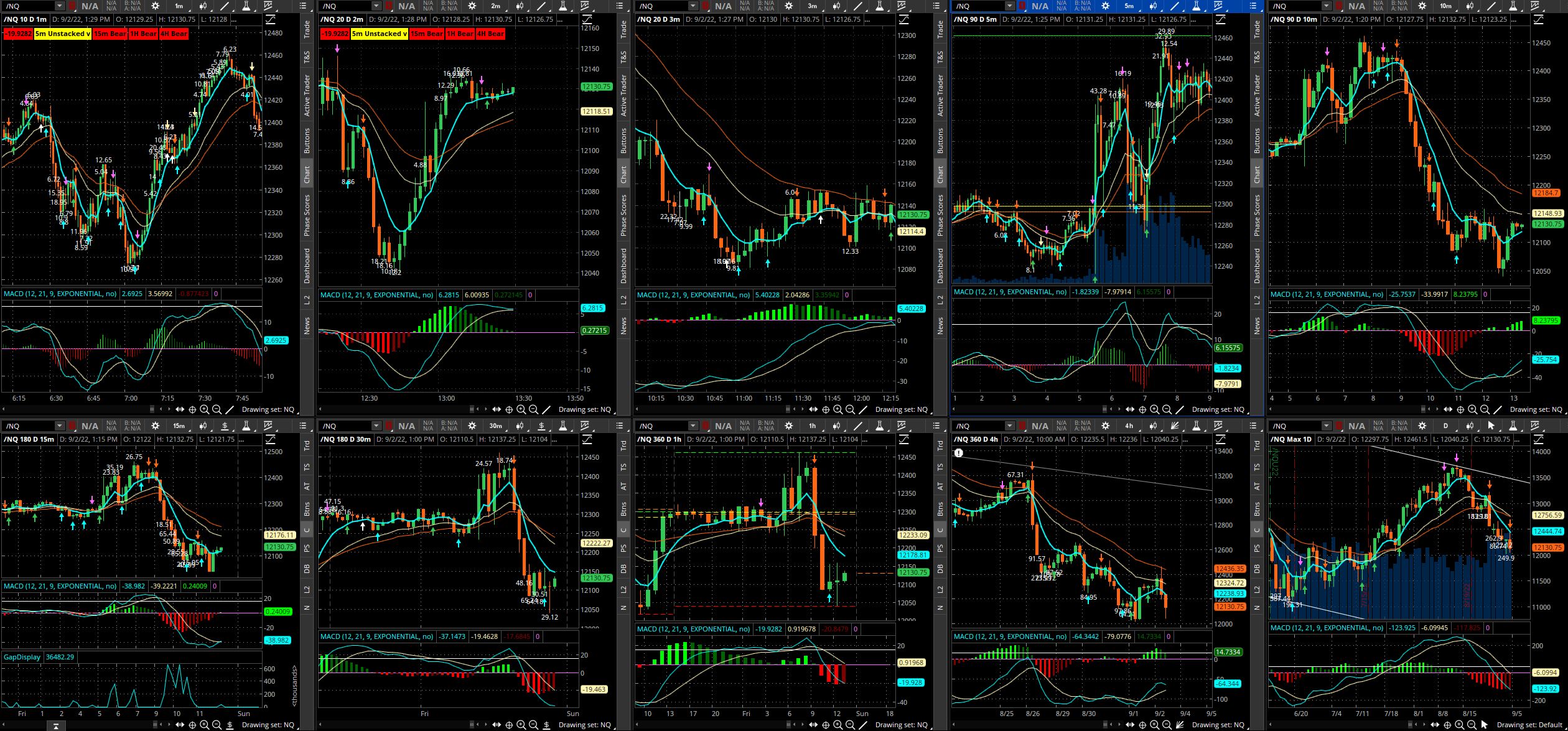

9/2/2022

Initial bullstack on 5-15-1H, 4H needing to hit 21/34 for next resistance. 1H potentially coming off 34, both 1/4 bullish overnight.

This is a similar development for our standard 1m 34-fake-wave-larger move setup, but has a much larger run up off the 5m 34, through a new high in fact.

Here, we have a 1m push down without the 34 touch, so we can wait for the 34 touch before going short for a new low. This is very tricky, because the 5m comes off the 34 first for this 1m bounce, which could convince us to hold a short afterward. But we know that the 1m needs a proper wave for it to run, so we must continue to wait.

We finally get the reversal off of 4H 34, with 5m bearish non-sig hammers at the top.

Note that the run down does not break the low yet.

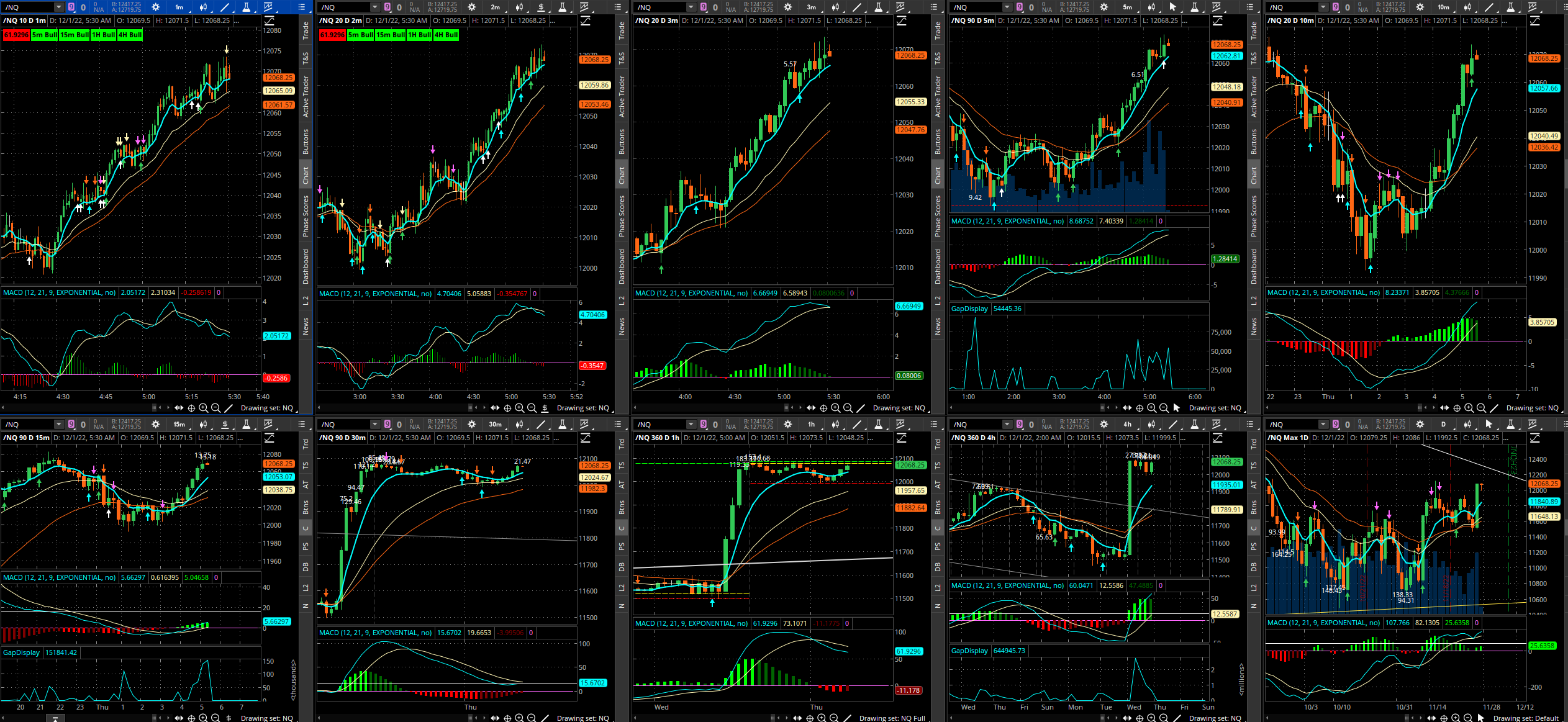

12/1/2022

This is getting interesting. We have another bullstacked market that dumps with the 5m, opens up and runs down on 1m (34 touch before the open), rebounds off the 5m 34, and makes a new high with a run of 100 points, finally running down off the 1m wave. However, the run down is almost in a straight line, and stops off the 1H 34. There is no full valley reversal, but it gets somewhat close.

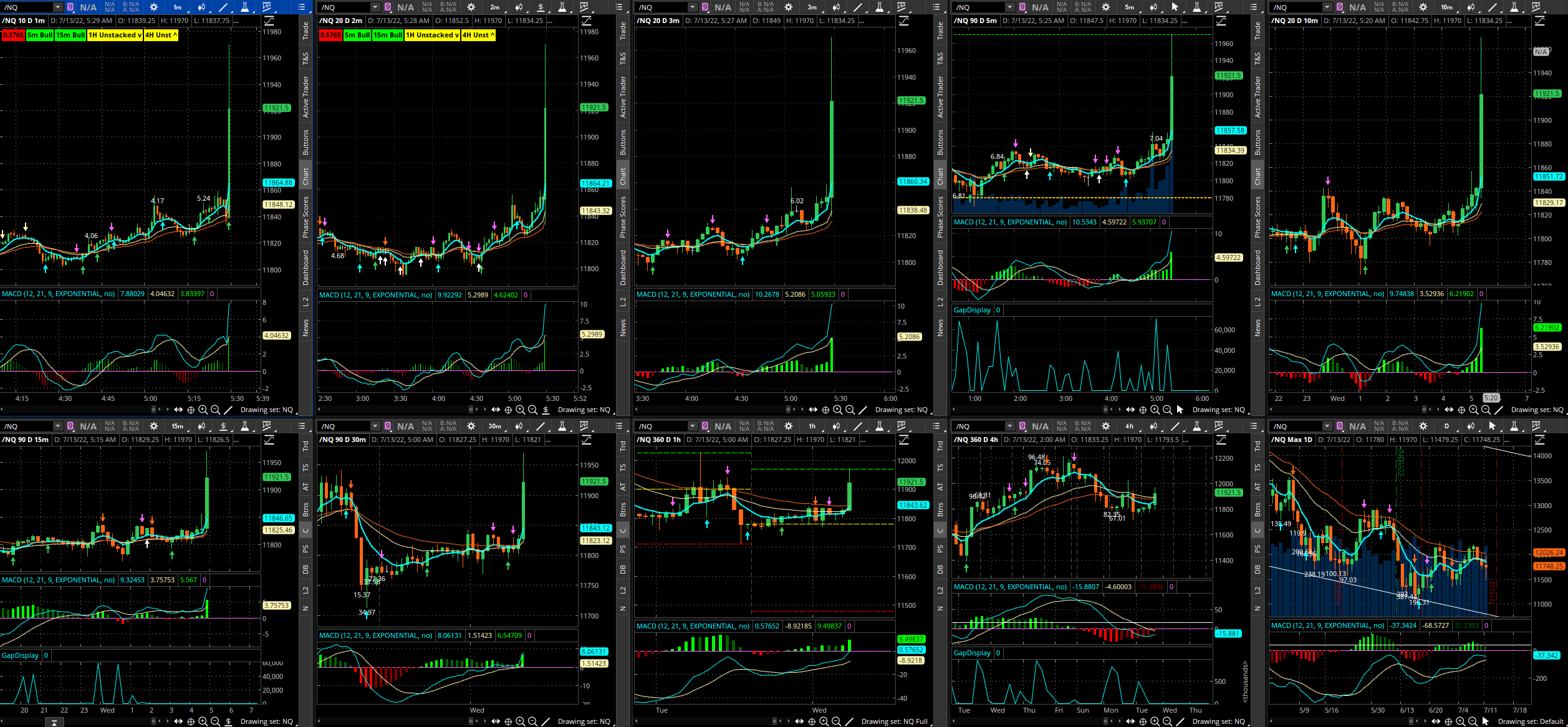

7/13/2022 – *

In this instance, the market is bullstacked on the short term, and bearstacked on 1H/unstacked on 4H.

Notice the resistance made by the recent low on 4H, this serves as the ceiling for the initial upward spike.

However, the market dumps against the trends, despite 1H also having a rising MACD. So we know there should be a bullish reversal at some point. 15m makes a bullish harami 7J right after the dump, so we know we can go long.

When 1m opens up just above 0, it chops, but tries to run up anyway. It uses the 21 here instead of 34, but does the same thing we’re used to seeing. Then, it hits the next major round number (700), pulls back to 600, makes a perfect bullish engulf and the valley continues.

The difference here, is that we do not get a full valley and further run. This needs further investigation (unk).

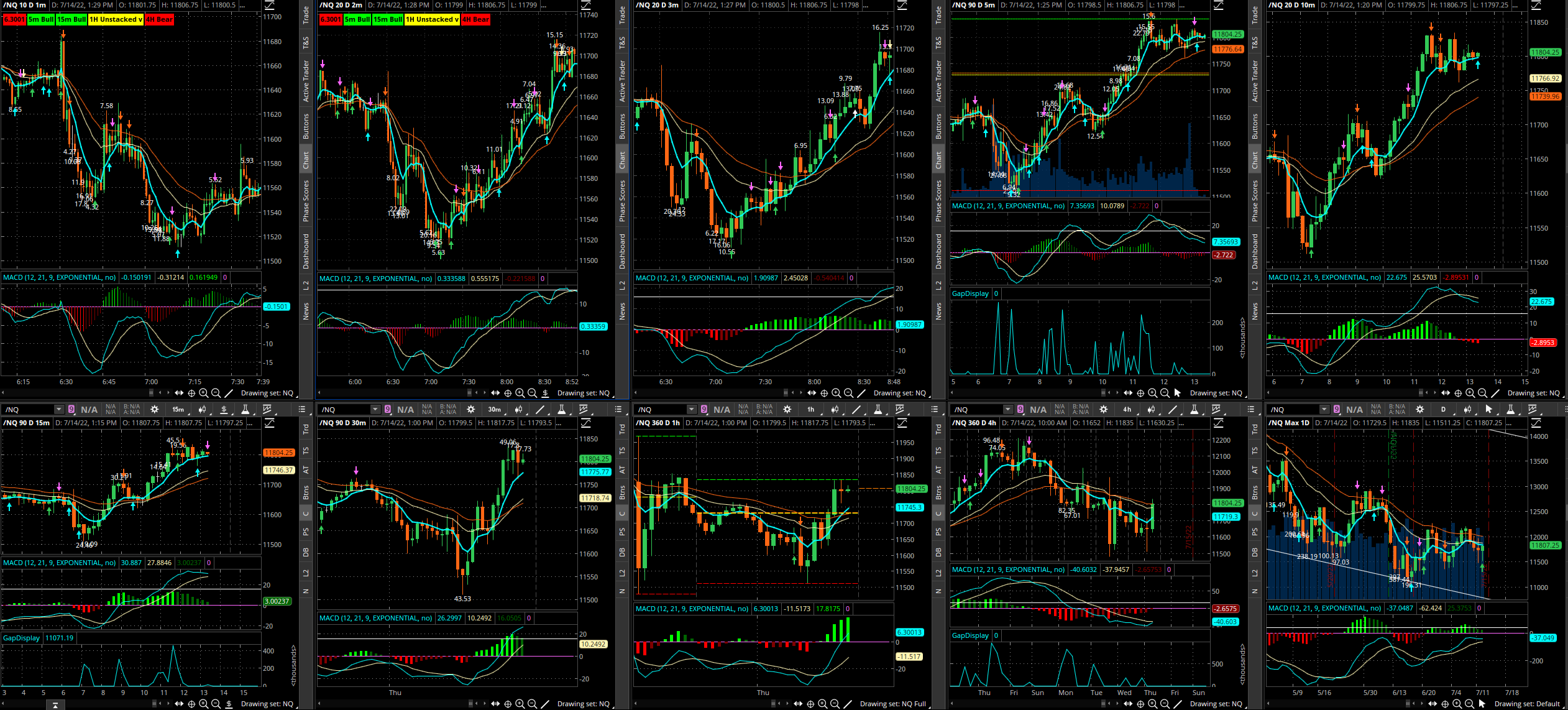

7/14/2022

After having a massive 530 news the previous day, we have a smaller one this day. This time, we have a fully bear-stacked market, and an initial pop up to test the 15m 34. Then, we get another pop up at the open, double-testing that previous high. This is something not too common.

Unlike the other situations with the 100 point pullback, we are traveling with the 5m trend here, so we don’t get a full 1m wave shortly after the open. We still get a 70-80 point pullback but have to use the 1m 34 first touch to take the first short.

Despite a fully bear-stacked market, we get a recovery late day, which I attribute to overdue bullish divergence on the 1H after yesterday’s massive news dump. It did not fully recover the previous day, so it seems that this day served as a second dump to gather enough power to pull higher, which happens the following day.

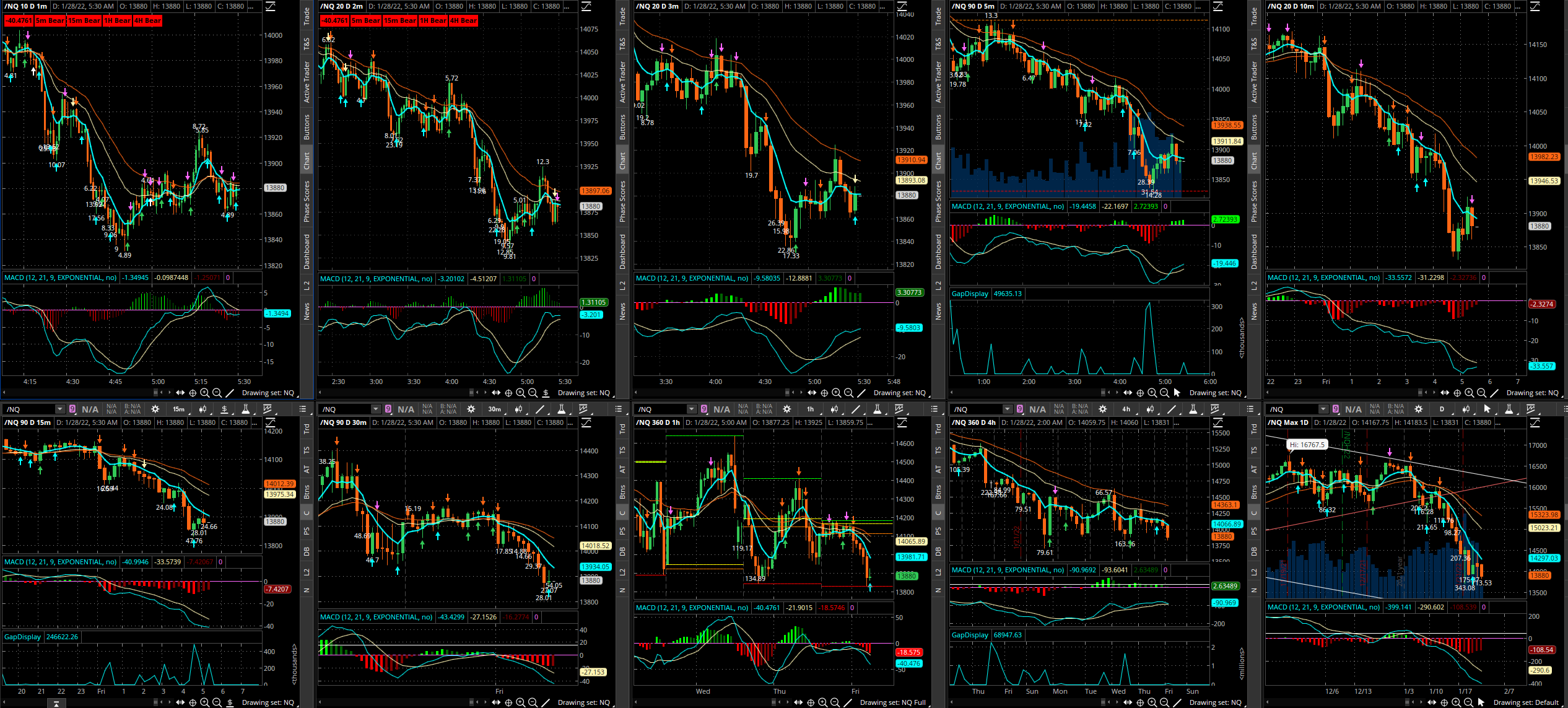

01/28/2022

Even though we have another fully bear-stacked market, we get another recovery, though this time it’s a little easier to forecast.

The 15m bullish harami shows up at the lows just before news, and 4H is creeping higher.

The news pops up with the 15m support, but runs into the 15m 34 along the way. Just like other examples, we look for the 1m wave. Right at the open, 1m is pushing through highs, but it’s already positive on 5m. So instead of a normal 1m 34 to high to pullback for wave, we have this happening on the 5m.

As it’s happening on 5m, we get about 230 points down, off of the 15m 34, until 5m makes a bullish harami which signals the long for the full recovery over the rest of the day.

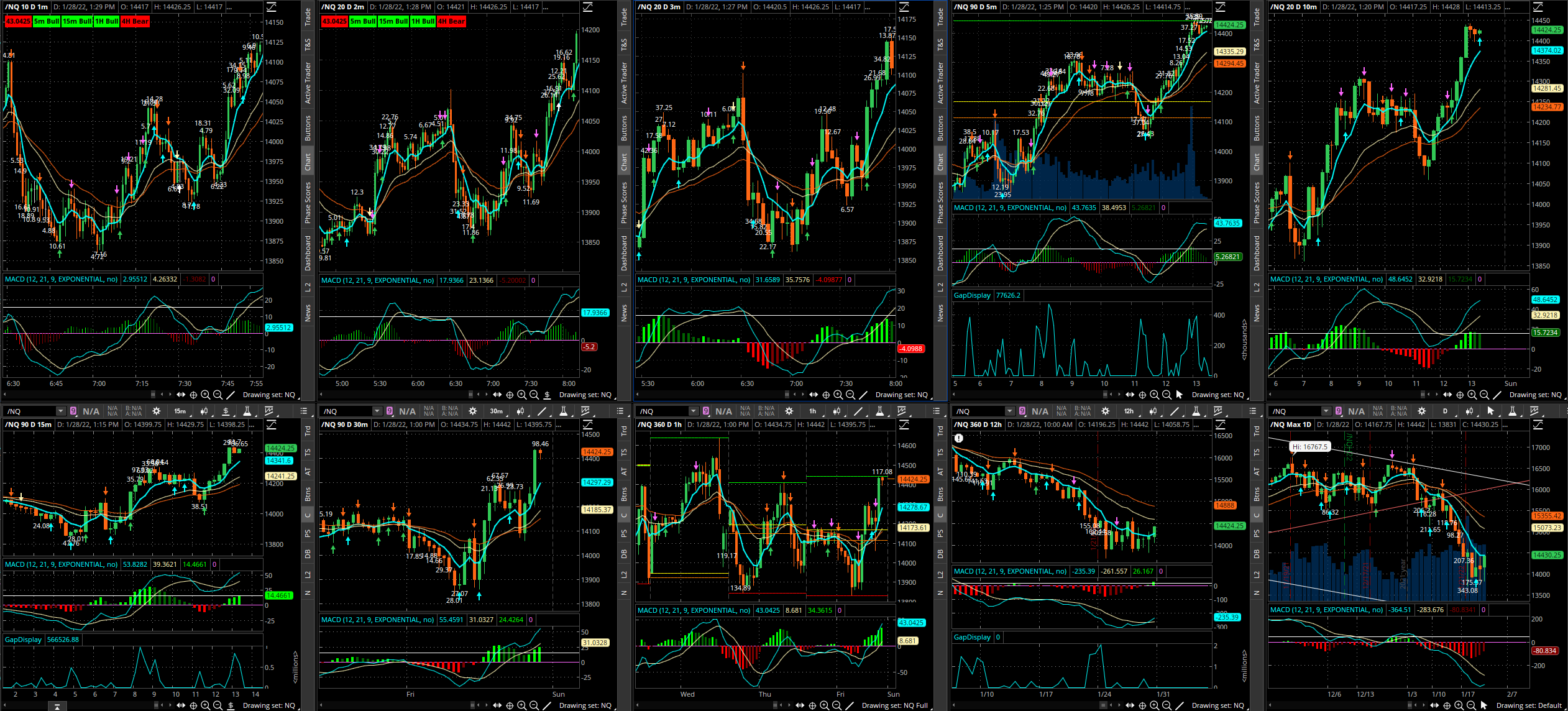

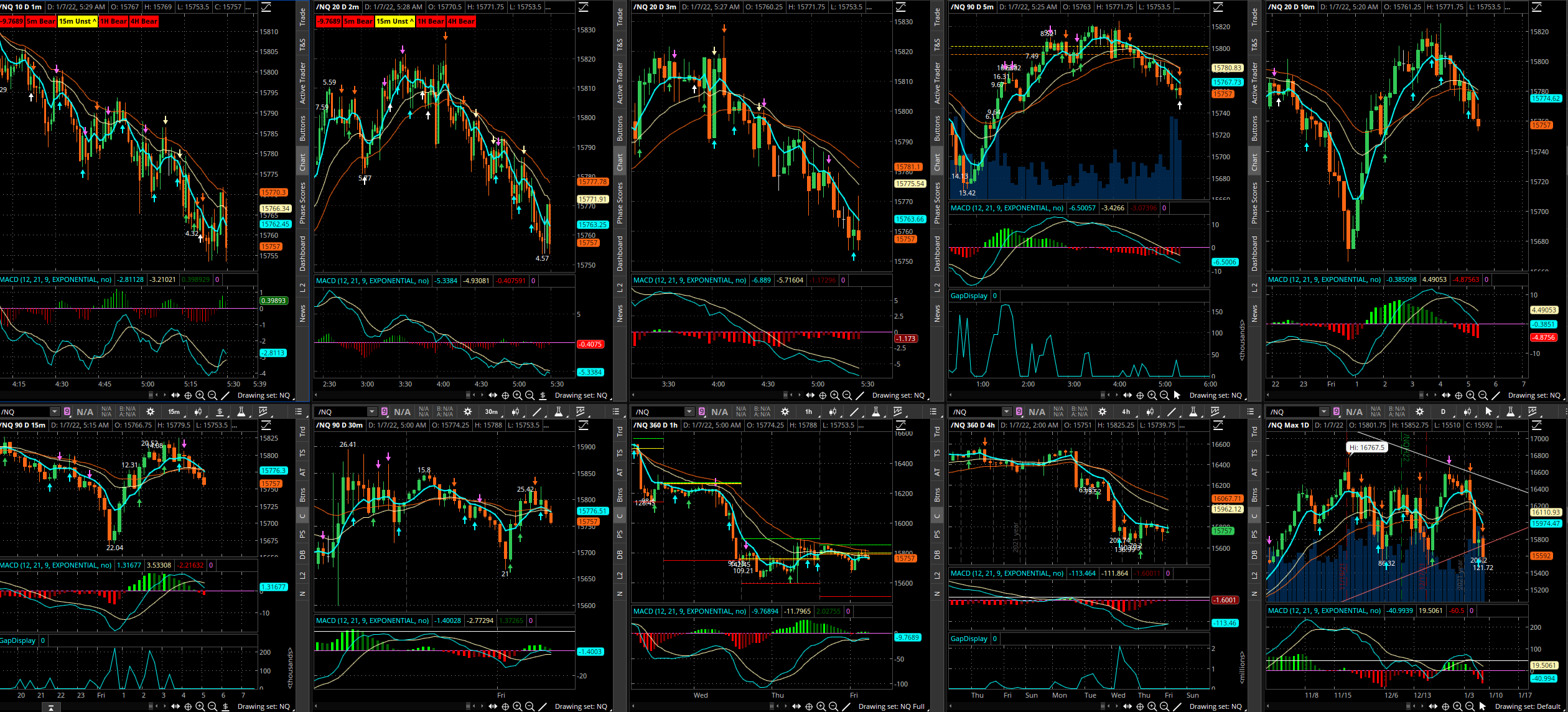

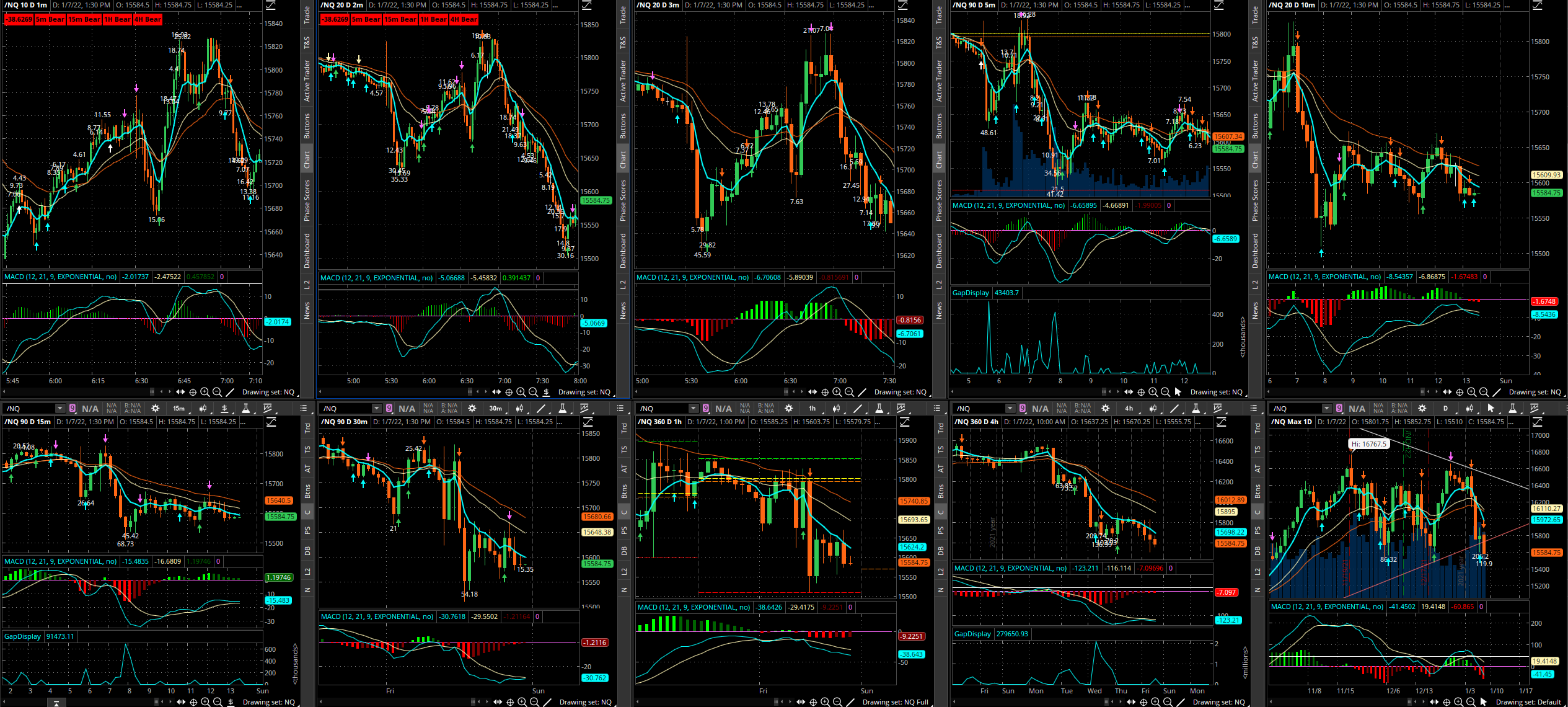

1/7/2022

Another superb example of the pattern shows up here.

Whole market is bear-stacked, but the news dumps initially, followed by a 15m bullish harami immediately, so we know it wants to recover.

However, the 1m already gets a 34 test right at the open, so shorting it has to happen immediately or not at all.

We get a nearly exact 100 point drop, and a quick bullish engulf on the 1m, which runs it up to undo the news, and then the original direction resumes. Overnight highs are tested immediately, along with overnight open/close at the same time, with previous day lows broken later.

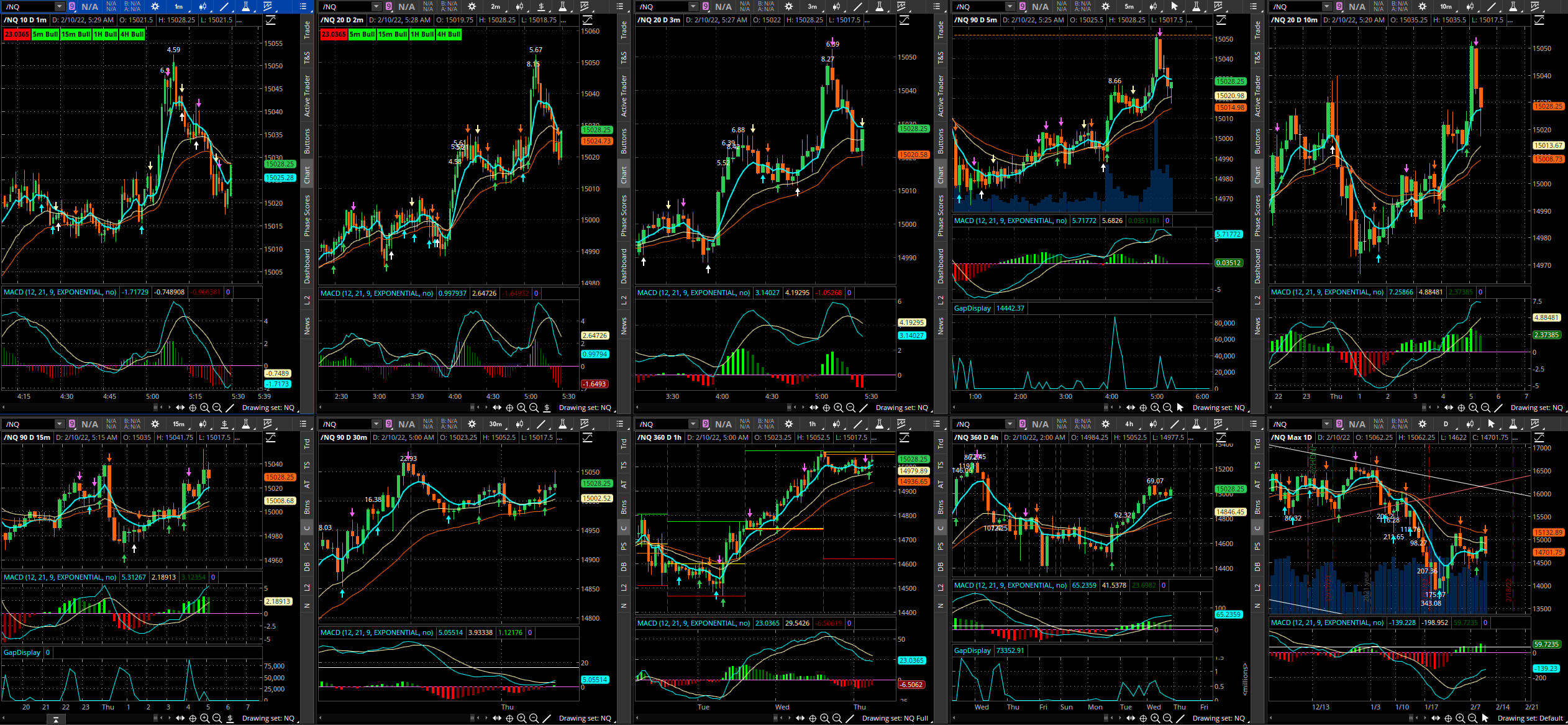

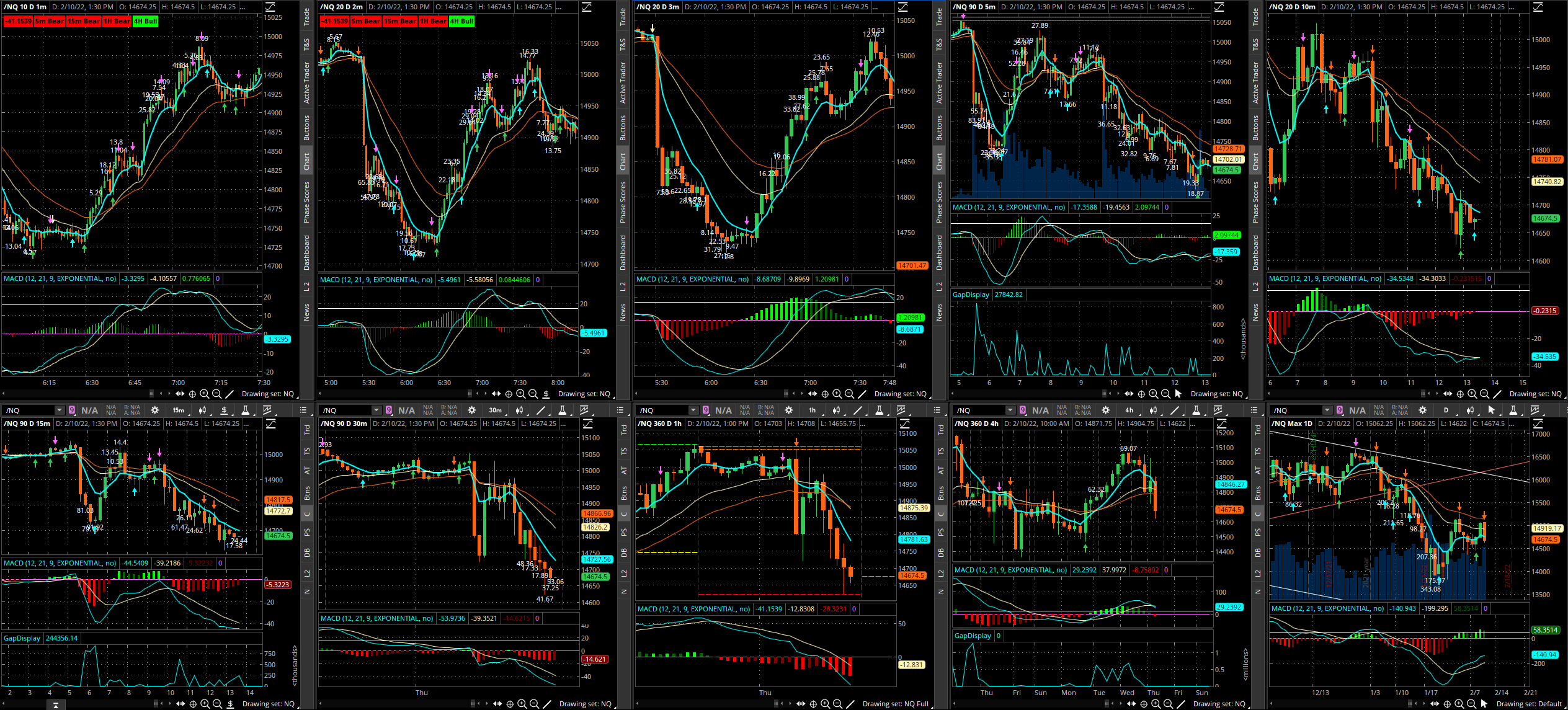

2/10/2022

This time the market is fully bull stacked, so we expect a bullish spike initially, but we get a dump instead. 15m takes 3 full candles before making a bullish harami bottom, after which we know we can go long.

Interestingly, 1m makes a bullish engulfing entry right before the open, and it is wise to take this, as there is no other signal to enter later. No pullback comes off the 5m 34, which maybe has to do with the 1m signal coming where it did. It’s almost a straight line recovery, after which the market dumps to continue where the news tried to go initially.

We can see the 1/4H are down overnight, which determines the direction.

5/11/2022*

Market is running up this time to start, but the 5 has a bearish divergence, and 4H has just hit the 21. We get a 1H wave/4H 21 combination this day. Also, no 15m bullish signal at the bottom, so while we get a recovery, it cannot sustain itself.

After the market opens, 1m comes off the 34 immediately to a new high, pulling back for the wave as expected. The pullback comes off the 5m 21 instead of 34, and it’s 150 points, before a sharp non-sig candle recovery on 1m. Maybe we just miss this one because it’s so different, but the 5m bottom is strong so it’s debatable.

Question to consider: Do we always get a 5 minute wave when we have a strong bottom/top like this? Should we make a protocol for taking the 5m wave and exiting and not anticipating a run, unlike other reversals with longer runs?

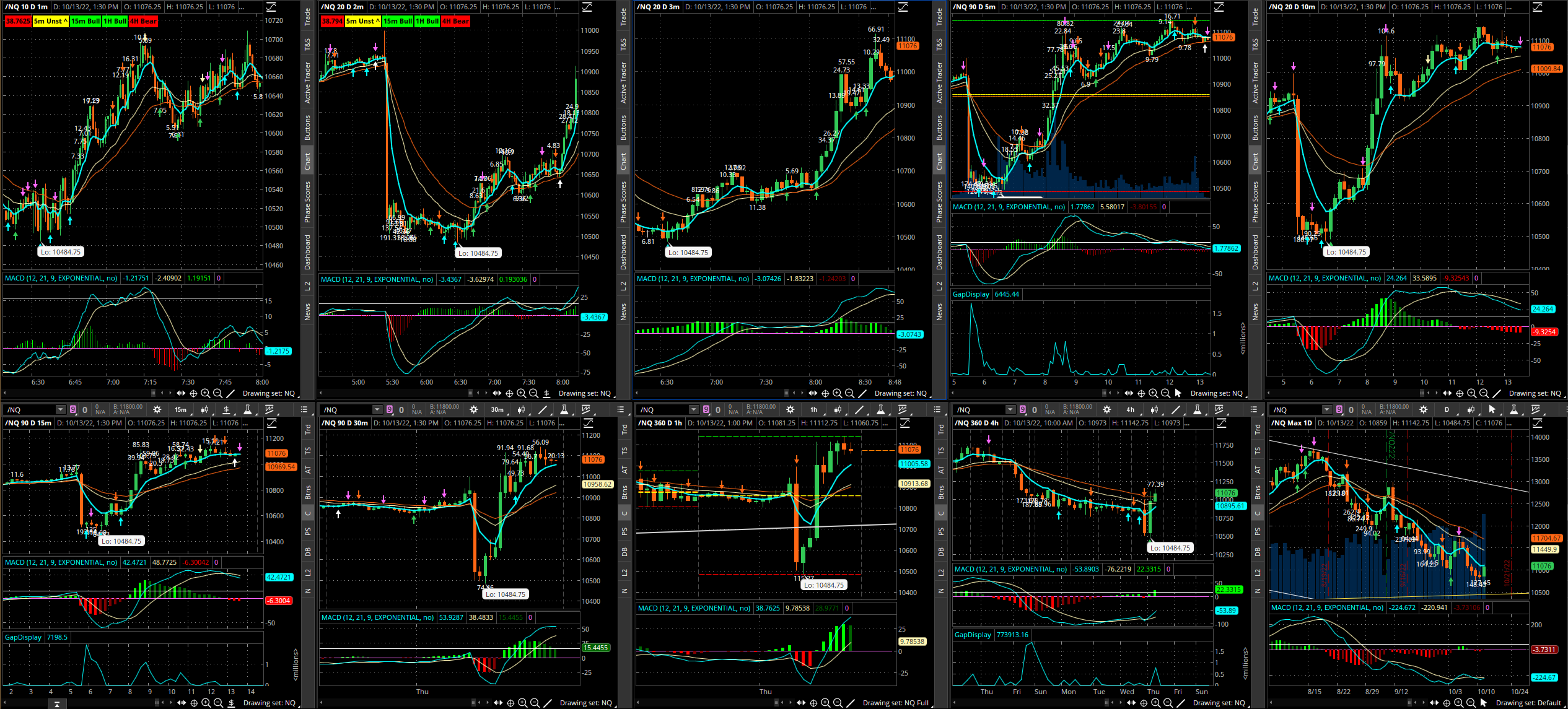

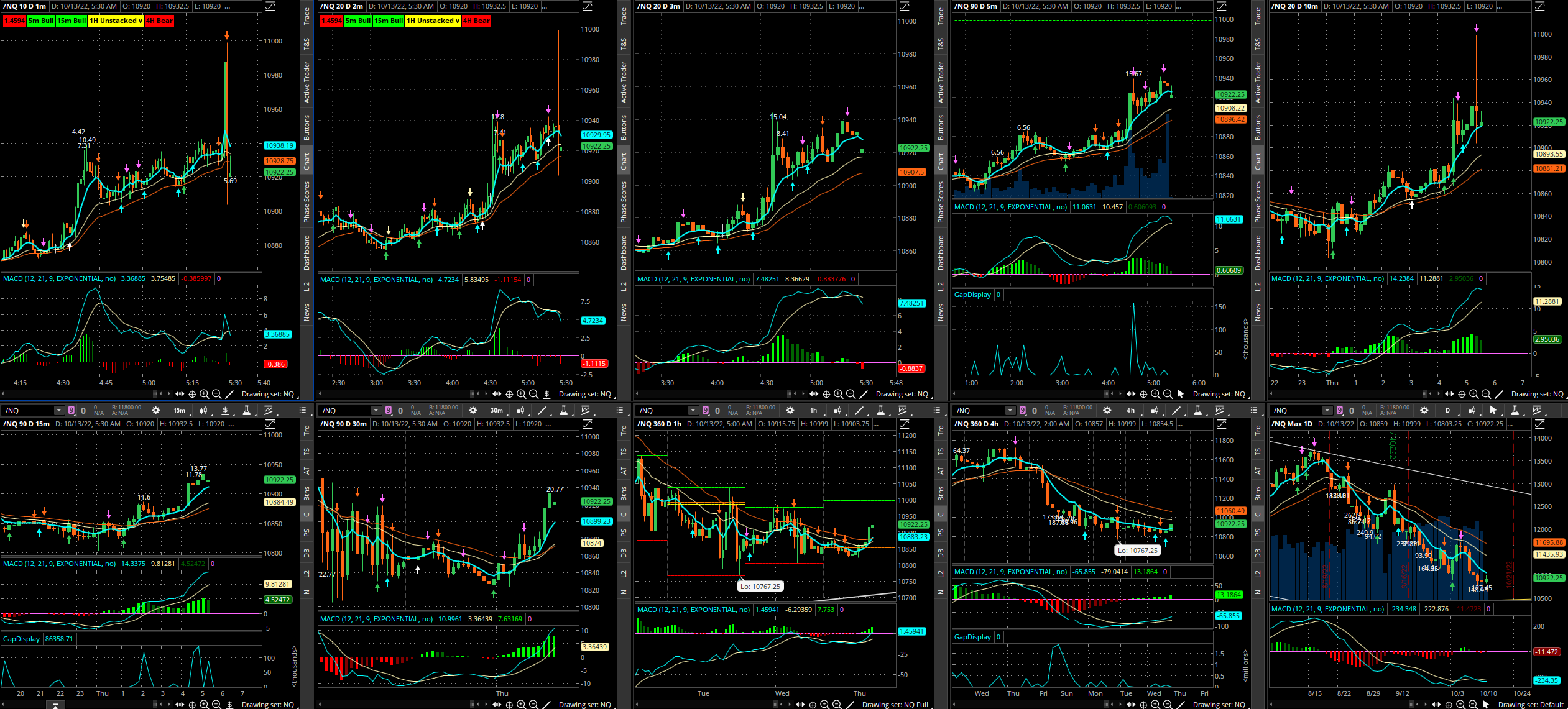

10/13/2022

The market is bull-stacked short term, bear stacked long term, but 1/4H are both on their way up. So we know this is to be a move that finishes higher. When 5m dumps, we can look for the bullish reversal signal, which comes with a 15m bullish harami immediately after the dump.

After 1m opens, it’s below 0, which means we don’t have a chance to wait for a down wave off the 5m 34 immediately. The open is congested off the 1m 34, setting new lows, but then reverses and runs into the 5m 34 as it typically does.

At the 5m 34, which is 45 minutes after the open, 1m has a double top/bullish long tail gravestone doji, which turns into the downwave we want off the 34. The run goes from low 600s to 1100s after this.